Own your money story.

FamilyFin Cloud brings your accounts, assets, spending, and goals into one secure workspace—then uses AI to surface savings opportunities and smarter allocation ideas.

Get early access — and influence what we build next.

We’re launching a limited Beta very soon. If you want to try FamilyFin Cloud early, tell us a bit about your use case. We’ll follow up with next steps.

- Early access to dashboards and workflows

- Direct feedback channel

- Help prioritize features that matter

Request Beta Access

Fill this form and we’ll email you when your invite is ready.

Spreadsheets are fine—until they aren’t.

Manual spreadsheets break under real life: multiple accounts, recurring bills, assets with changing valuations, and shared family expenses. Errors creep in, data gets stale, and insights arrive too late.

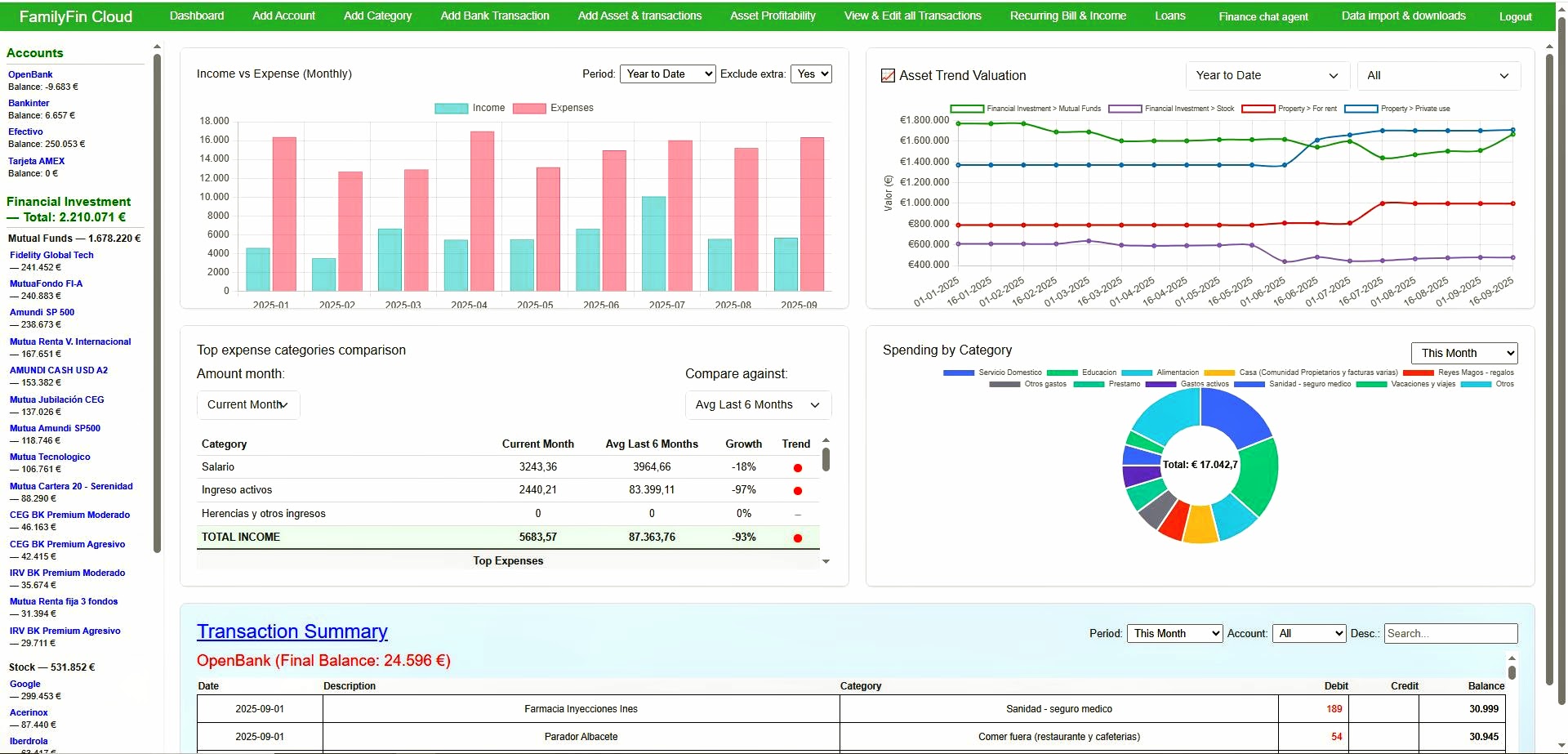

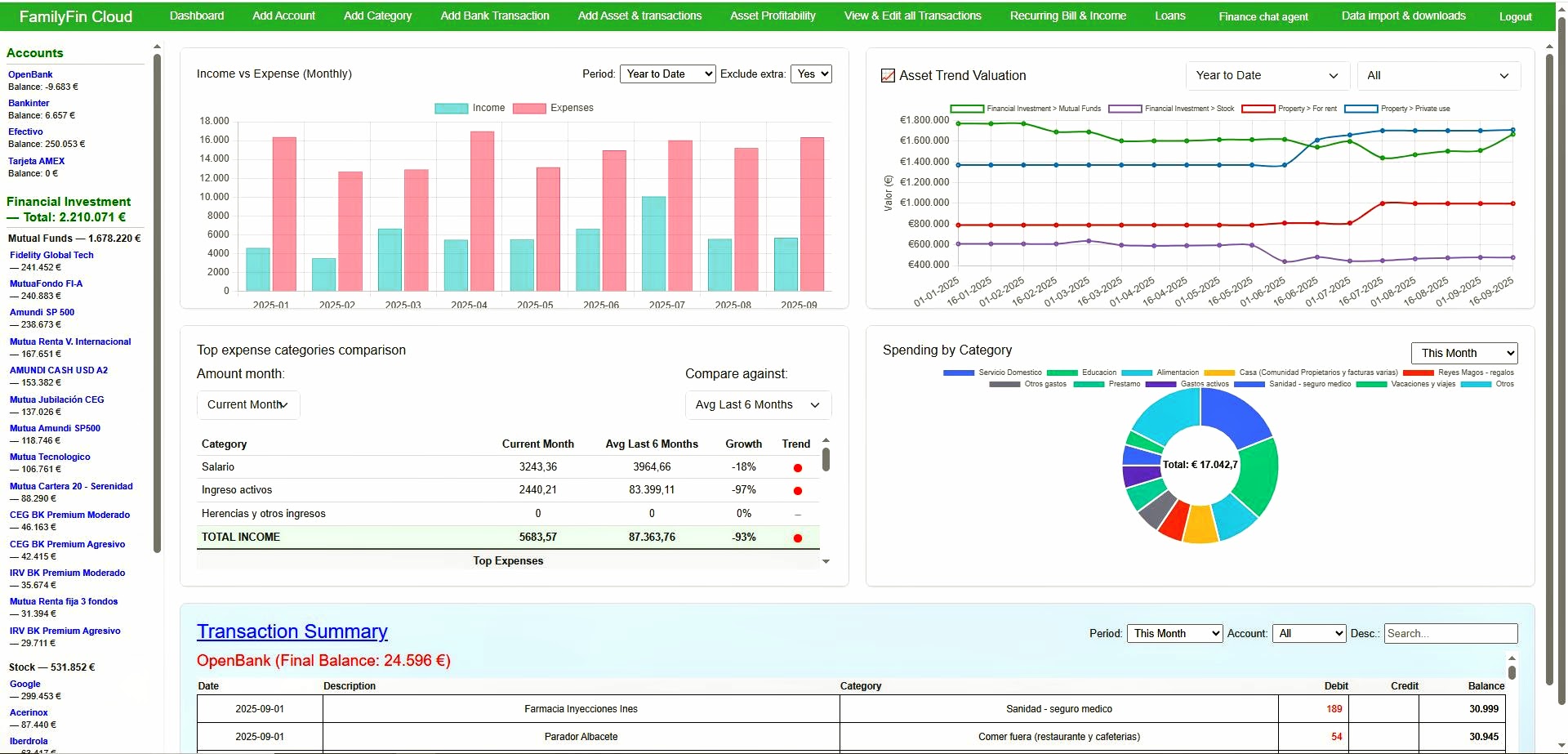

- Unified view across accounts, assets, and cash flow

- Actionable guidance—no formula wrestling

- Built for families: shared budgets and clear goals

Life won’t wait—small delays compound.

Inflation, changing rates, new family milestones, and evolving goals all demand a sharper view. The earlier you start, the more compounding works for you—not against you.

- Upcoming expenses need a clear runway

- Market shifts reward disciplined contributions

- Debt costs drop with timely, informed actions

- Savings opportunities are easier to capture with visibility

Near-term clarity

See what’s committed, flexible, and smart to postpone.

Mid-term momentum

Plan 6–24 months ahead: goals, savings, and debt payoff—tracked.

Tame recurring costs

Spot subscriptions, fees, and leakages. Keep what serves you.

Confidence & calm

Know where you stand and what to do next.

Cloud-first. Private by design. AI that actually helps.

What sets us apart from generic budget apps and static spreadsheets.

100% Cloud

Use it anywhere. No files to sync. Your family stays aligned.

Encrypted & yours

Your data stays yours. We do not sell personal data.

AI insights

Recommendations: savings areas, smarter allocations, benchmarks.

Complete picture

Accounts, transactions, assets, loans, goals—plus trends.

Customizable

Categories, dashboards, and rules tailored to your household.

No dark patterns

No confusing paywalls. Just tools that help you decide better.

AI that’s transparent, explainable, and useful.

Our AI analyzes your spending, trends, and asset history to propose concrete actions. You’ll always see the “why”.

- Savings ideas (subscriptions, fees, duplicates)

- Allocation nudges (emergency fund, debt, investments)

- Benchmarks (public cohorts & countries)

- Scenario planning (what-ifs over time)

Answers to common questions

Want early access?

Join the Beta and help shape the product.

Questions? Read the FAQ or request Beta access above.