Get up and running with FamilyFin Cloud

This short tour shows how to set up your accounts, categorize transactions, track assets and loans, plan recurring bills, and use our AI finance chat for insights.

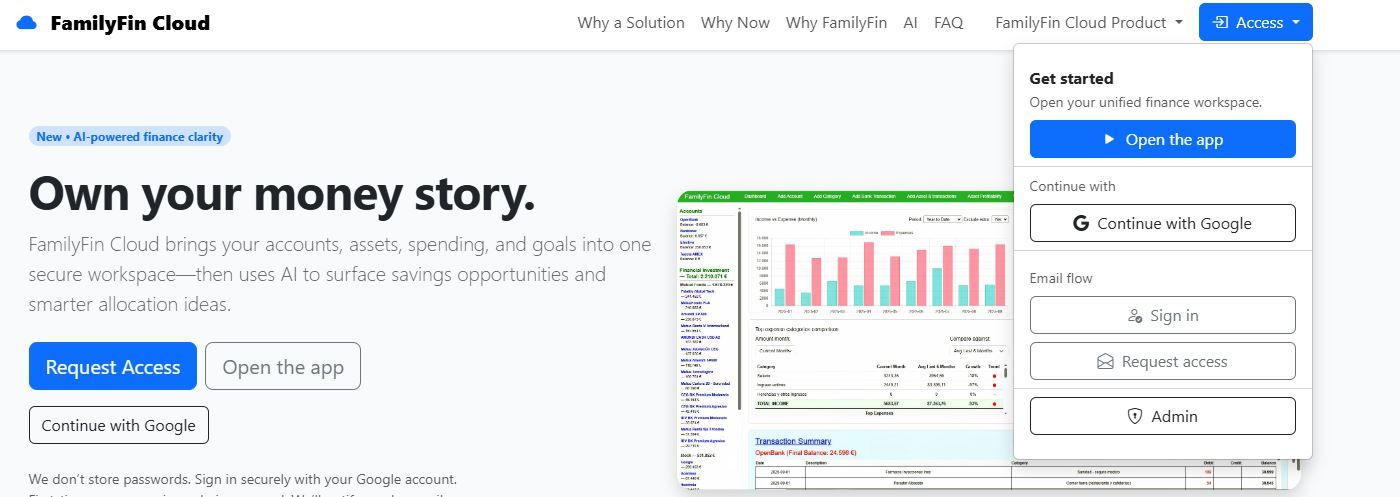

Public site overview

FamilyFin Cloud has a public marketing website where you can learn why a dedicated finance solution beats spreadsheets, why now is the right time, and why FamilyFin Cloud is different. From there you can start this Quickstart, request Beta access, or ask questions.

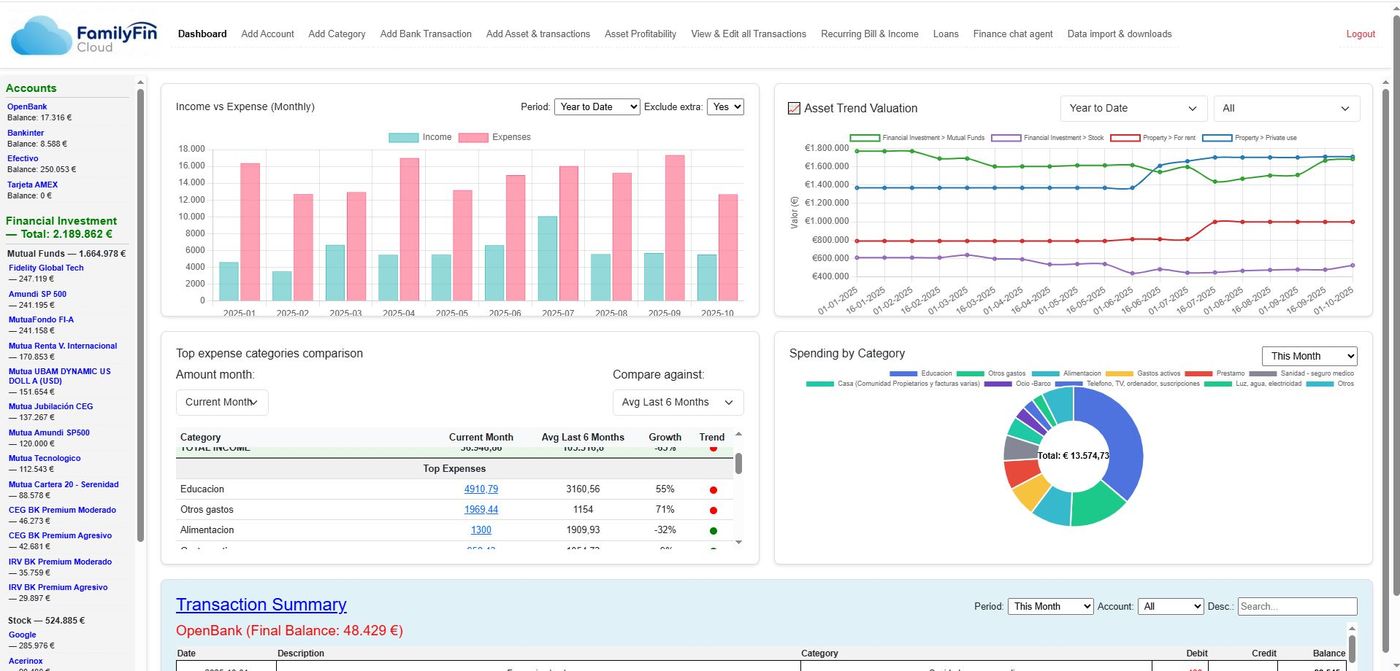

Dashboards & toolbar

The app’s home is split into three areas: a top toolbar with the main sections, a left sidebar showing current balances and asset values, and a central area with dashboards for a full picture of your finances.

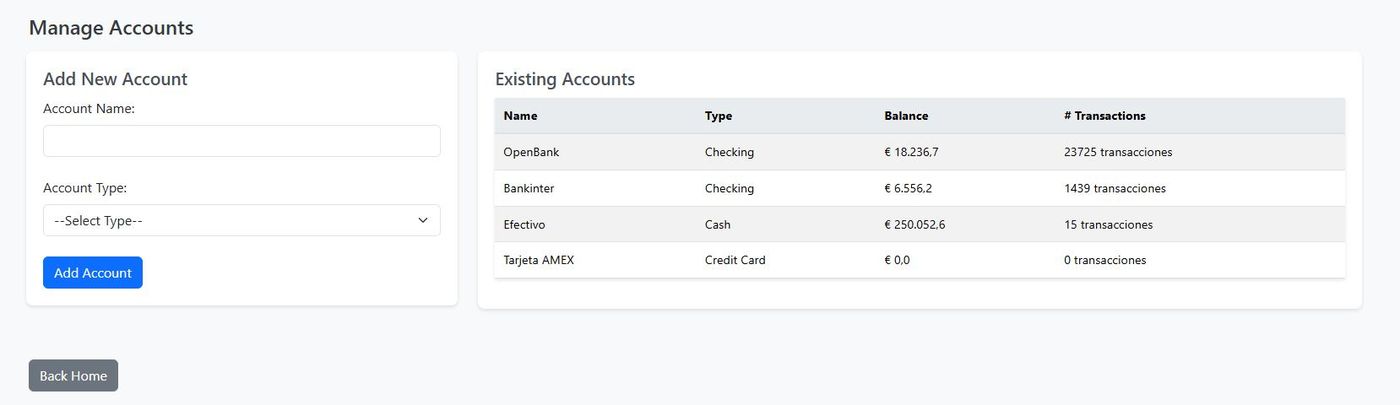

Accounts

Create your bank accounts (checking, savings, cash, credit card). Just name them in Add Account — balances update automatically from your transactions.

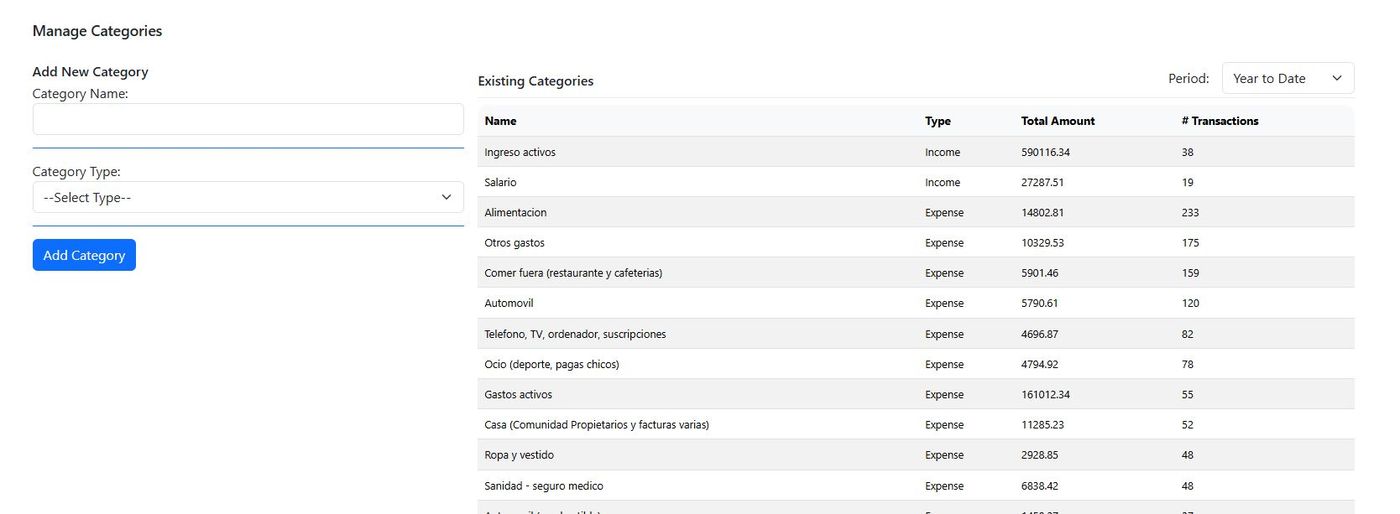

Categories

Organize your money with flexible categories. Each one must be Income, Expense, Transfer (moves between your accounts), or Loan. We recommend special categories for Asset income (dividends, rent) and Asset expenses (purchases, fees).

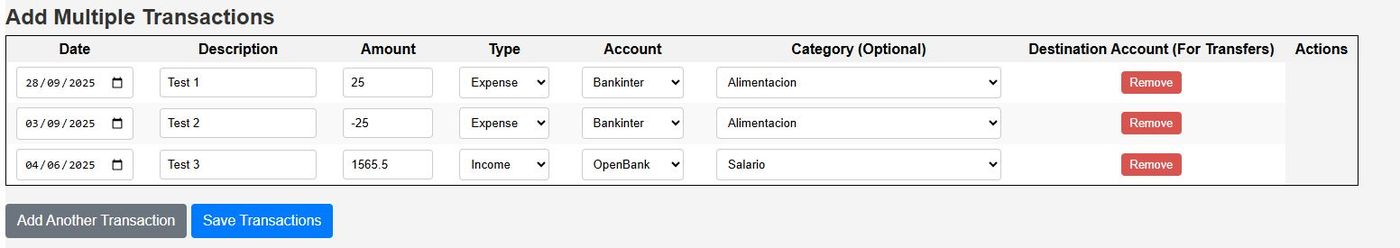

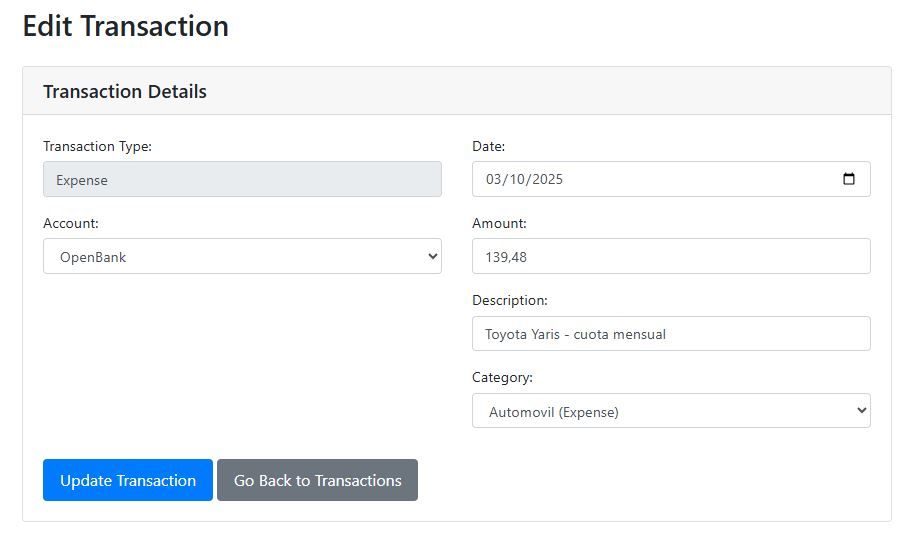

Bank account transactions

Once accounts and categories exist, you can enter transactions manually or import them later by CSV. For each transaction, set Date, Description, Amount, Type (Income, Expense, Transfer), Category, and (for transfers) the Destination account.

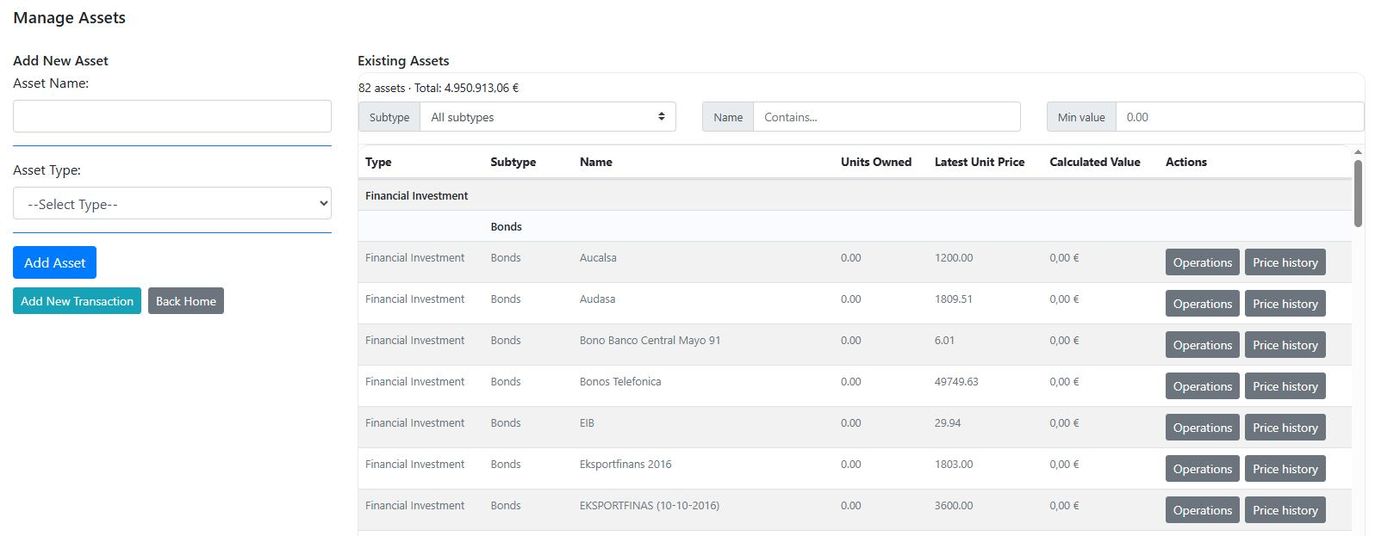

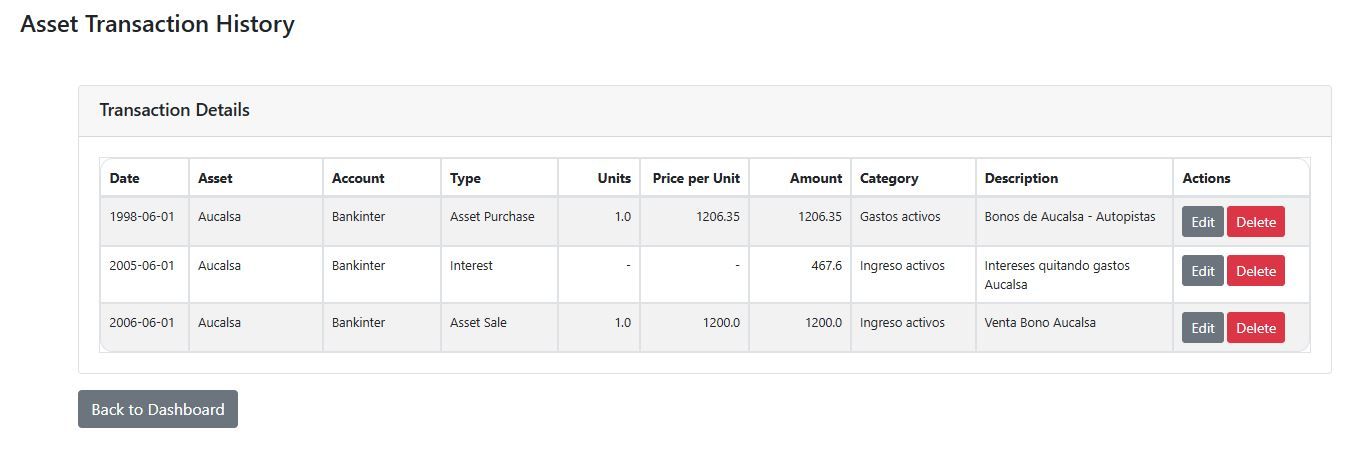

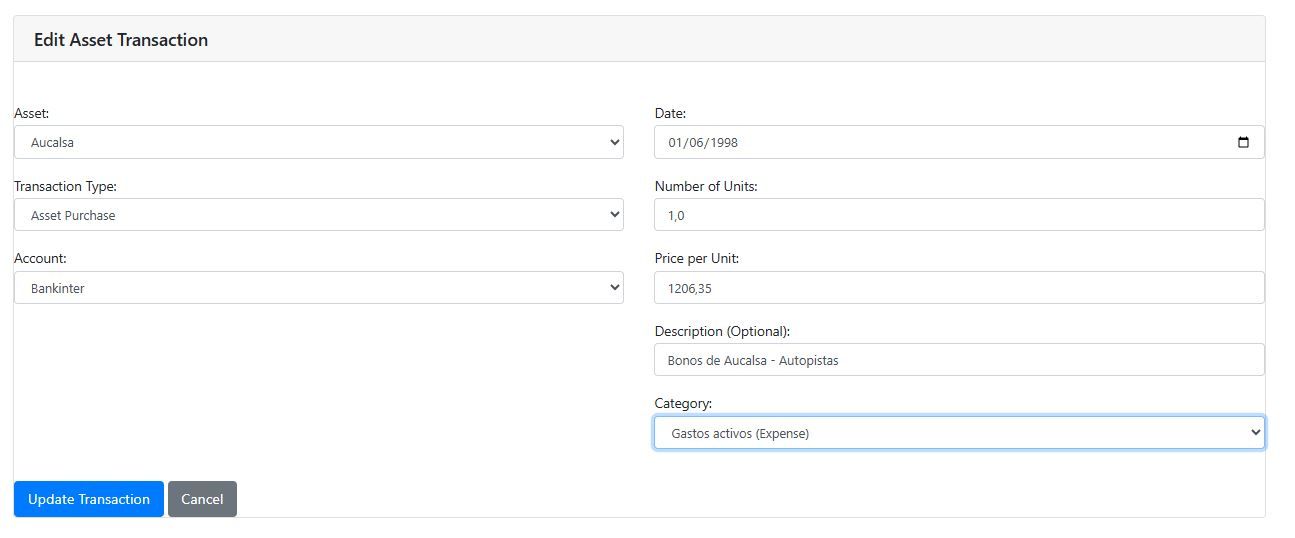

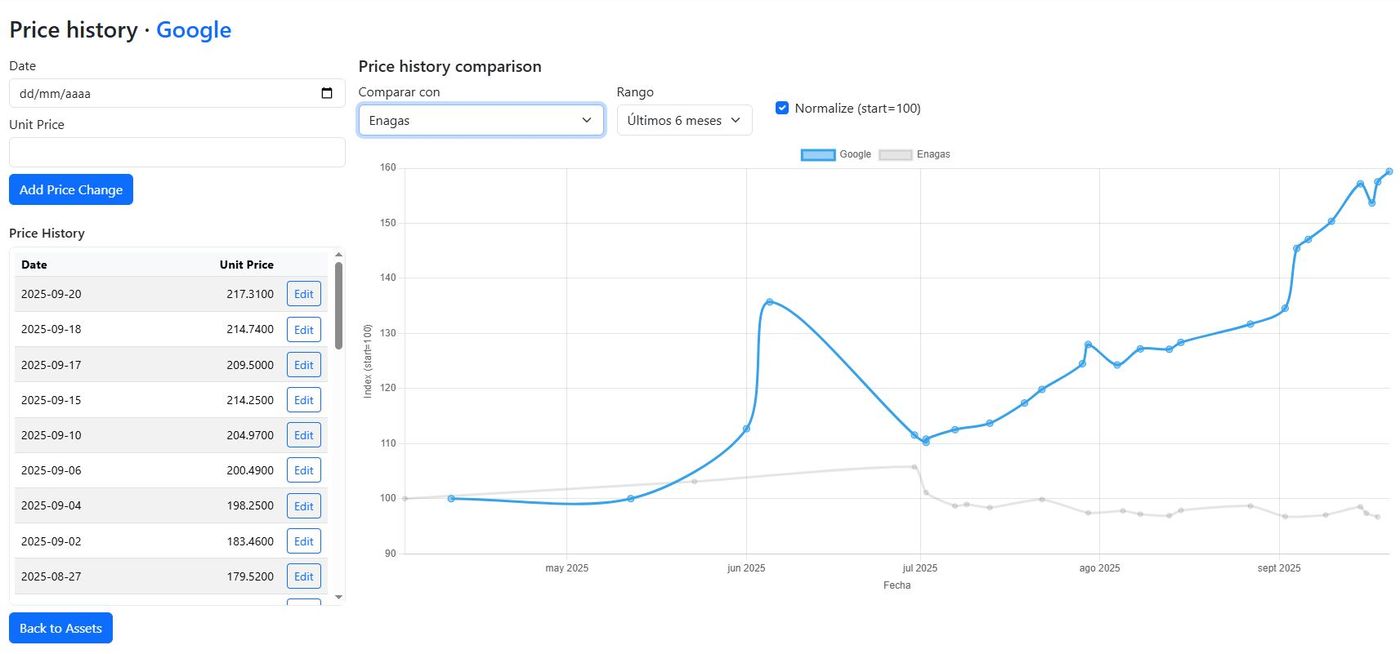

Assets

Track performance and history for all your assets: Financial Investment (Stock, Mutual Funds, Bonds, Other), Property (Private Use, For Rent), and Other assets (vehicle, boat, etc.). Record operations like purchase, sale, dividends, interest, and asset expenses.

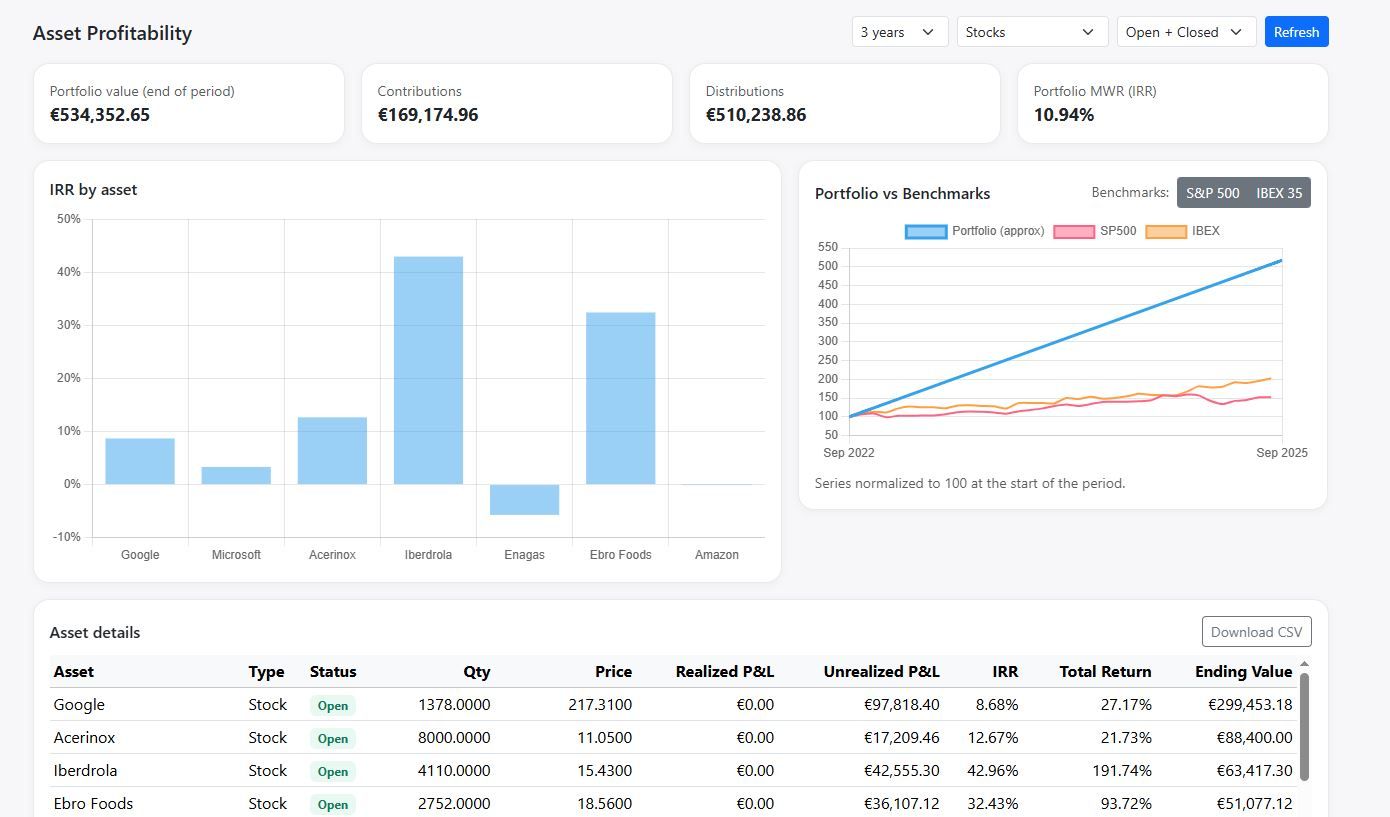

Asset performance

See portfolio performance and history: IRR/MWR, realized & unrealized P&L, total return, and benchmark vs indices.

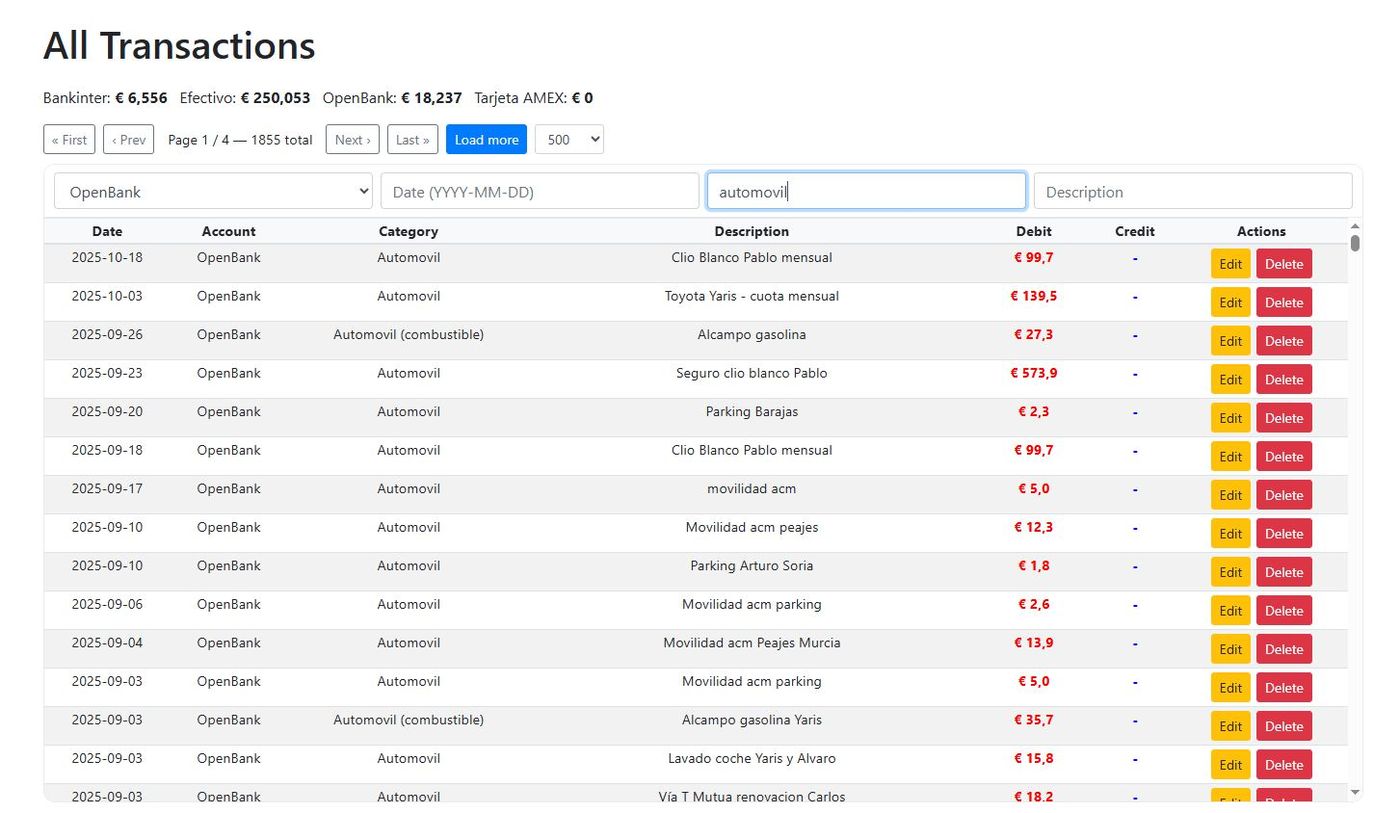

All transactions

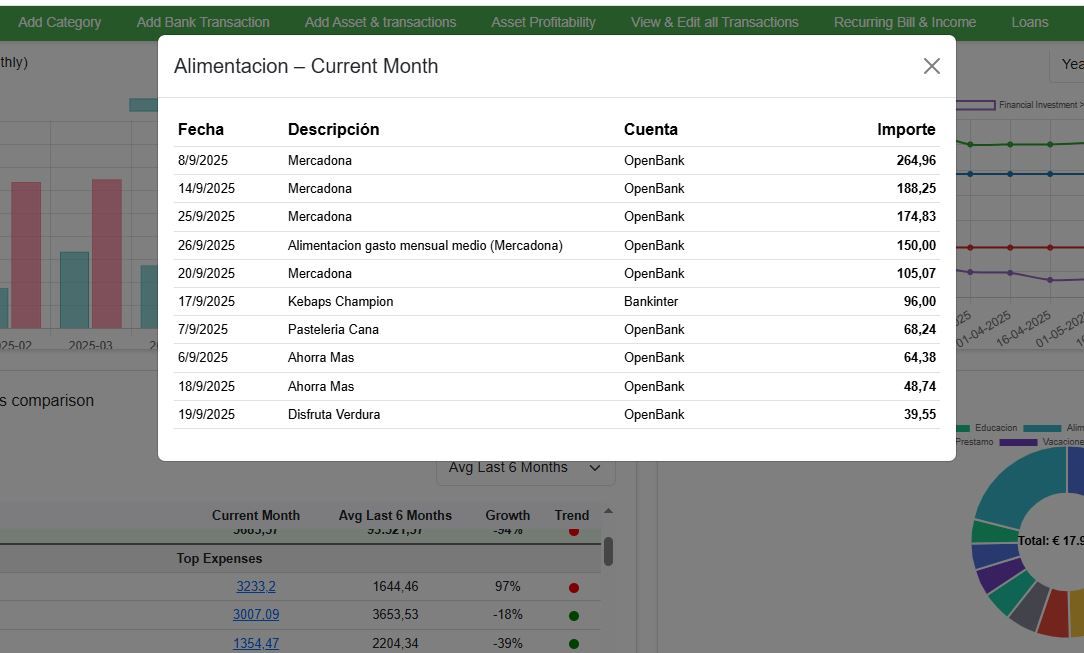

Filter, search, edit, or delete any transaction across accounts and categories.

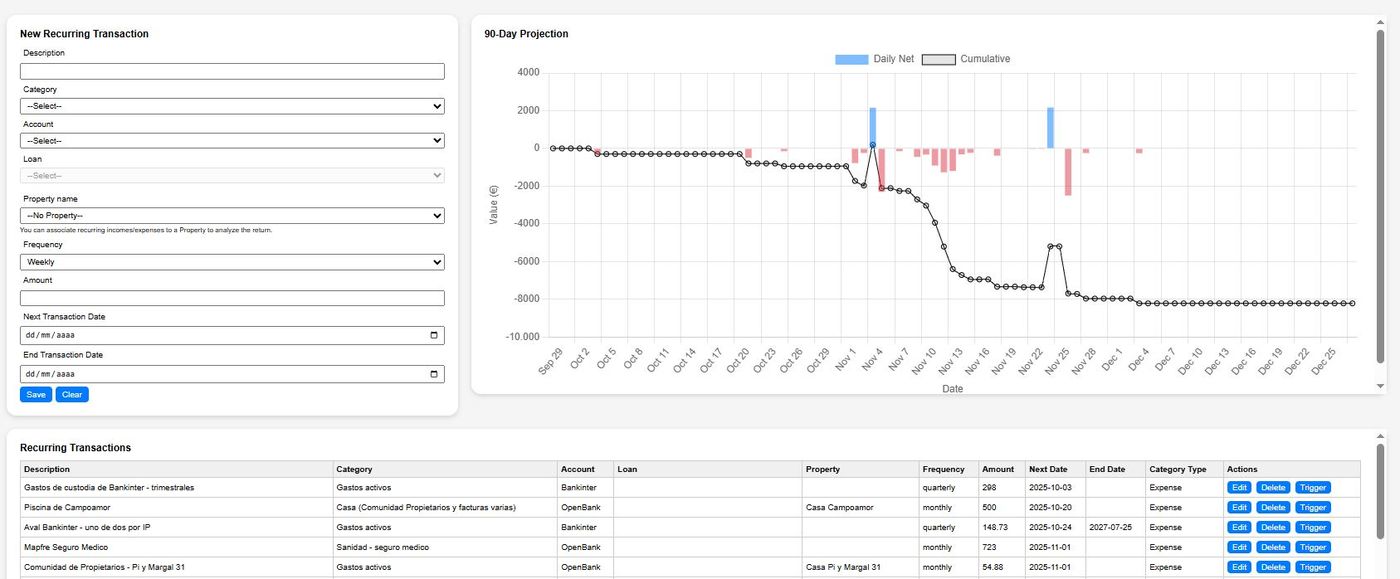

Recurring bills & income

Most monthly movements repeat. Define them once with amount, account, frequency (weekly, monthly, quarterly, yearly) and optional end date. Get a cash-flow projection and reduce manual data entry.

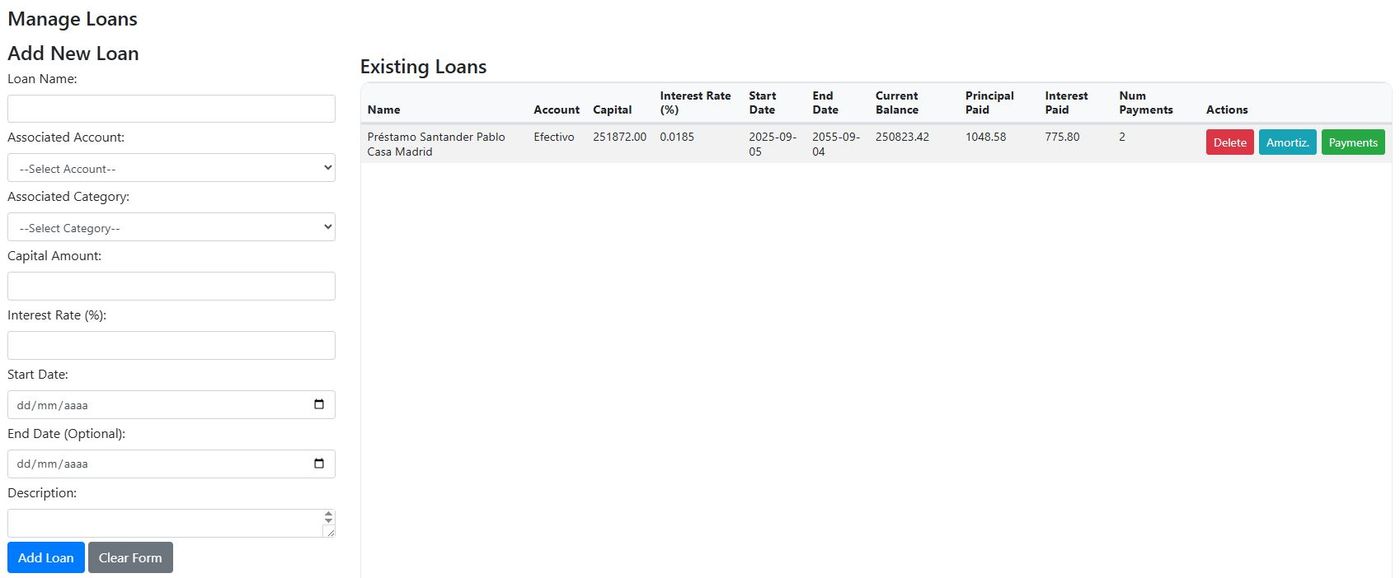

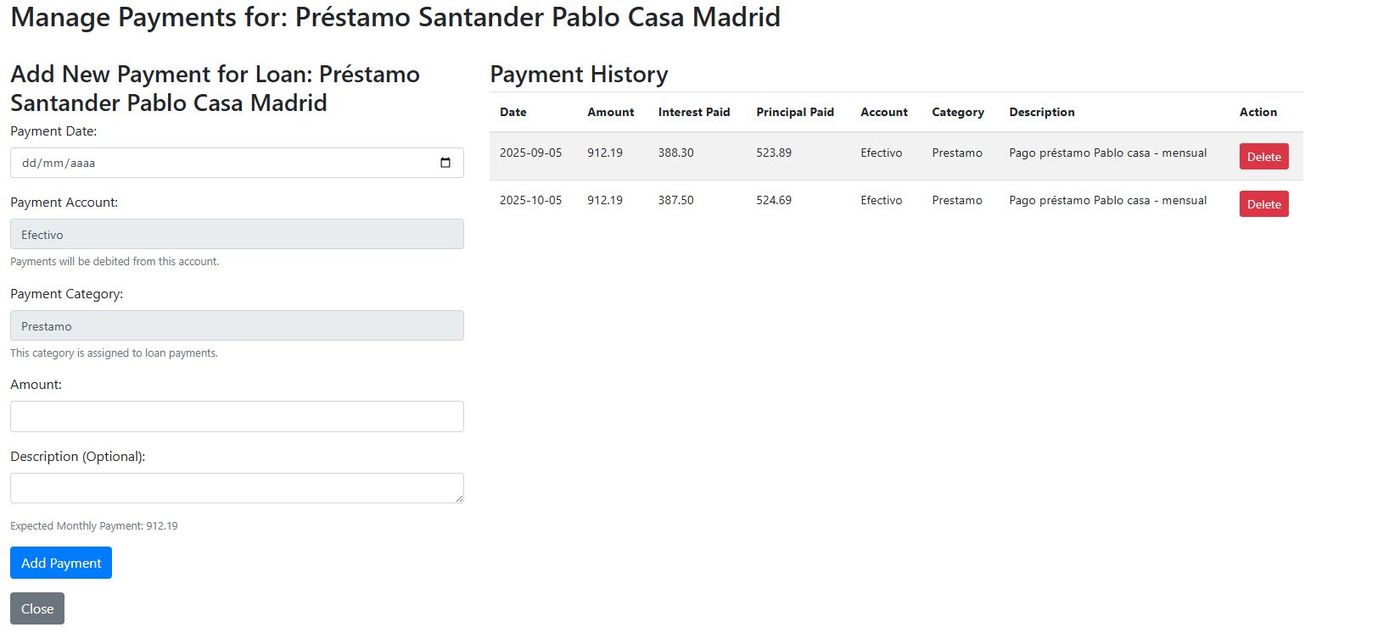

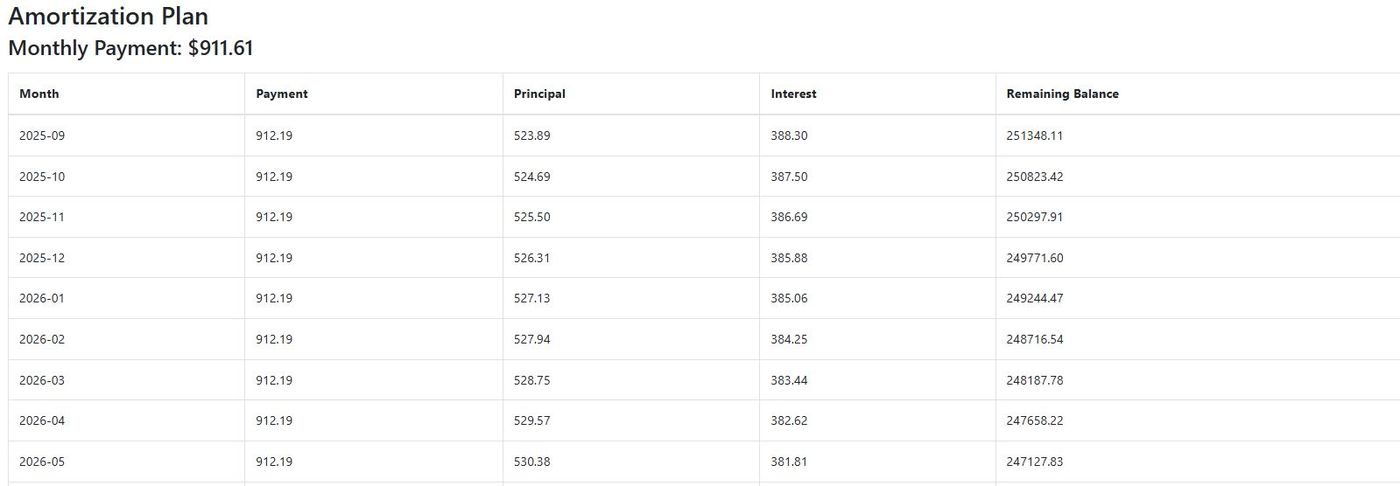

Loans

Capture name, associated account, category, capital, interest rate, start/end dates and description. FamilyFin Cloud generates the full amortization plan and lets you manage payments.

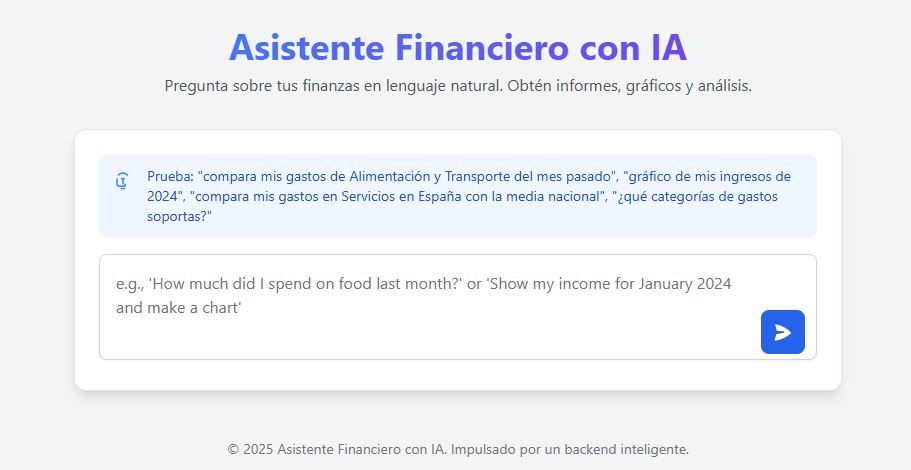

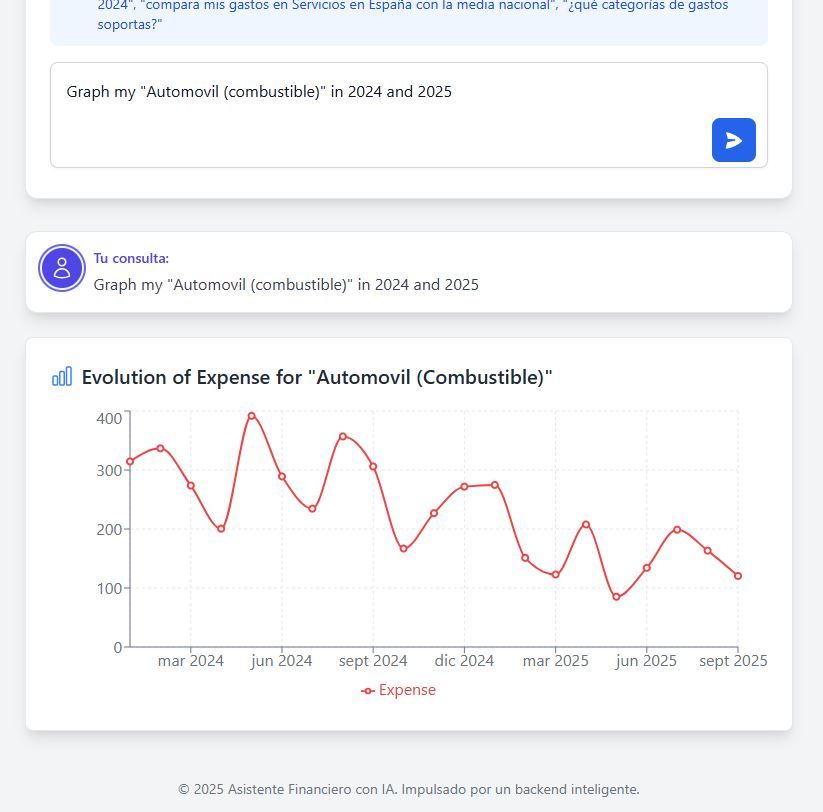

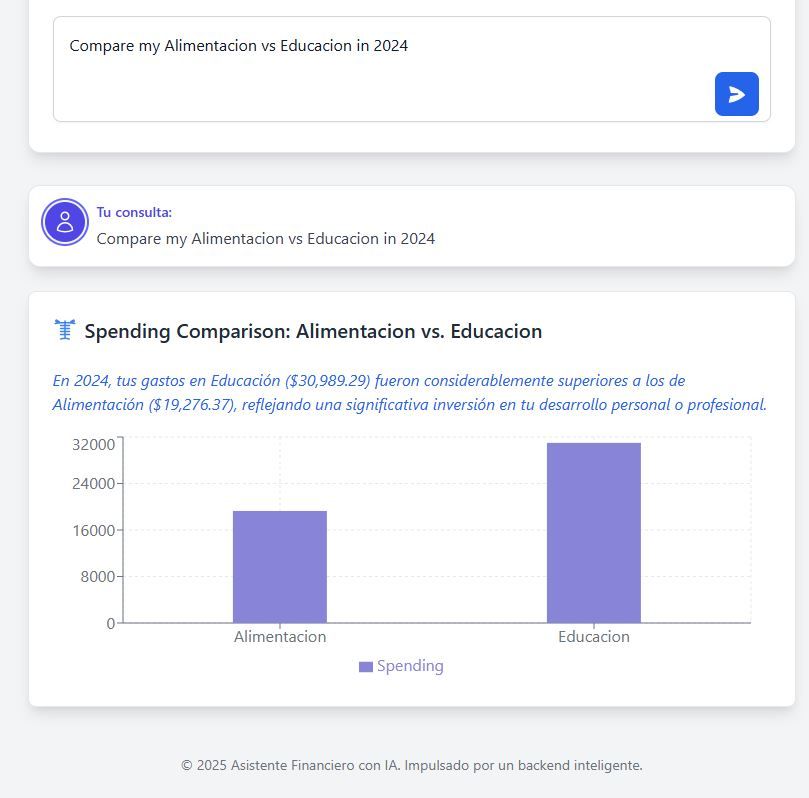

AI finance chat agent

Ask in natural language (English or Spanish): category details, charts by period, comparisons, or benchmarks. Get guidance on where to save more or allocate better.

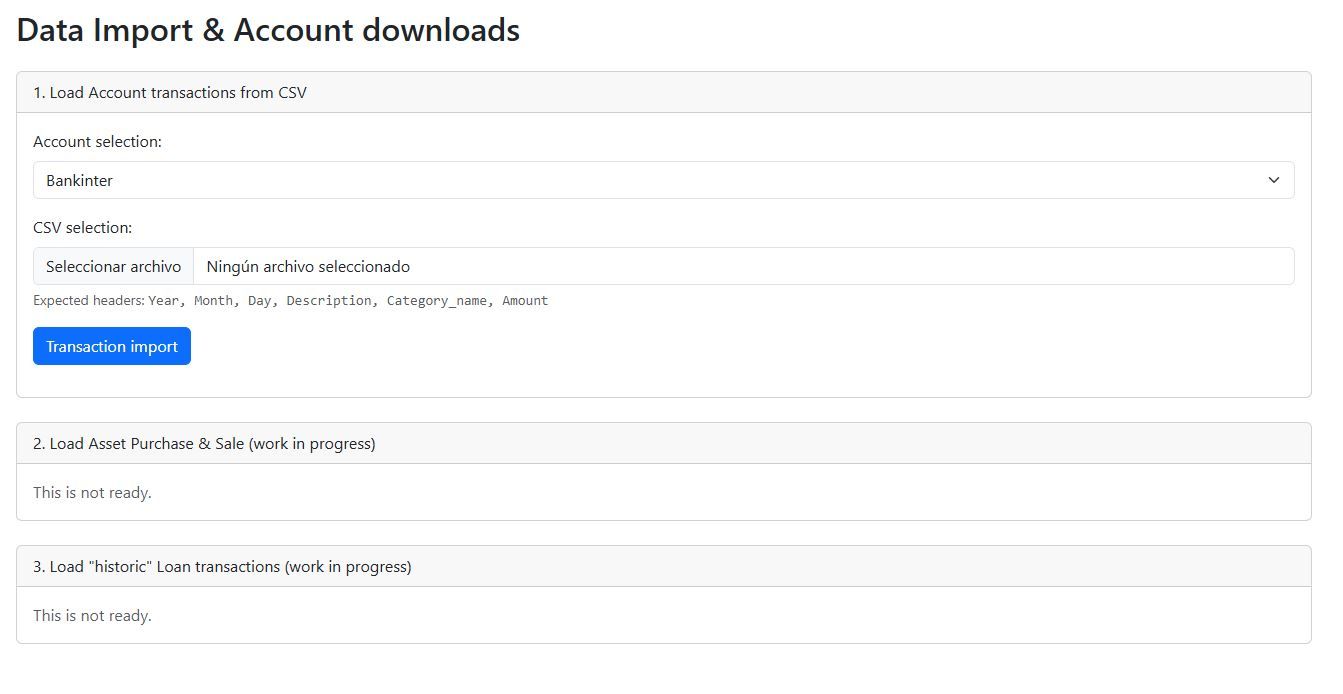

Data import & downloads

Upload CSVs with your bank transactions. We also use clustering AI to suggest categories based on your history, improving with each import.

Sign out

You can sign out anytime from the top bar. Your data remains private.

Screenshots may show sample data for illustration purposes.